Cuts in pay, workweek longer

Has your boss cut your pay? Taken away overtime? Reduced your workweek? Eliminated raises? Chopped your benefits? Put you on an unpaid furlough? Join the millions who have seen their take-home pay flattened by the double whammy of recession and its 9.8 percent-and-still-rising U.S. unemployment rate.

Latest Median IT Salaries

For the latest data go to the current IT Salary Survey

Compensation in 2009 has been cut by the largest amount in nearly two decades, with a government index of real average weekly earnings down 1.9 percent since its high point last December. And the average workweek — now down to 33 hours — is the shortest on modern record.

Some pay cuts have gone far deeper than the aggregate data indicate.

Order Salary Survey Download Salary Survey Sample

A 35-year-old Kansas City architect, and his wife, also an architect, have both taken 20-percent pay cuts this year. “We’re struggling right now, but we’re making it through with the children and day care and trying to make ends meet. It’s definitely a lot tougher,” he said. Typical of many, they accepted the sacrifice.

Compensation cuts have sliced across the board. But most workers who’ve been nipped and tucked are clear on one point: They’re still in better shape than the more than 7 million U.S. workers who have lost their jobs in this recession. The unemployed have suffered the biggest pay cuts of all.

“The ones who have jobs are willing to give up a lot to keep them. They’ve seen the alternative,” said a compensation consultant.

A driver for YRC Worldwide Inc., accepts that wage reductions are the cost of business survival in this recession. He took a 10-percent wage cut in January, followed by another 5-percent cut in August. “Even with the pay cut, it’s still been a good wage,” he mused. “My kids are grown up and out of the house, so it’s just me and my wife,” said the 51 year old, who’s been an over-the-road driver for 23 years. “It would be worse if I were a dock worker. Drivers can usually make up for pay cuts by working longer.”

That resilient attitude is shared by many workers.

Fortunately, too, paycheck chiseling has been muted by recent deflation in core consumer prices, giving the sense that most workers are running in place financially.

Still, the cuts make workers cautious.

A government employee, who works for the Unified Government of Kansas City, Kan., and Wyandotte County, has to take one unpaid furlough day a month for 15 months.

Like 17 percent of U.S. employers who have had unpaid furloughs this year, his employer mandated unpaid days off as well as freezing 2009 and 2010 pay (excluding public safety workers).

“It amounts to a 41‚Ñ2-percent pay cut, which is definitely taking a bite out, but it’s a better alternative than laying off more employees,” said the employee.

“It was great to have a long weekend, but when the paycheck came it was, ‘Oh boy, there’s not as much there.’ So, yes, my wife and I are being a bit more careful about making big purchases.”

That common reaction to paycheck slicing has put the fear of a lousy holiday shopping season into retailers. Chapped by layoffs and pay cuts, consumer spending has dwindled.

Cautious spending is a logical reaction when workers paid by the hour have, on average, seen their weekly work hours plummet.

Total pay for private production and non-supervisory workers — which accounts for about 8 in 10 members of the work force — fell for an unbroken 10-month stretch, beginning in August 2008.

In 1981-1982, the most recent recession in which the job market tanked as badly as this one, the same index fell for only two consecutive months.

Even in the “hot” industries where workers are in demand, pay has tightened.

An area director for a Professional Staffing Firm , said a national survey found a salary decline of 0.85 percent expected next year for finance and accounting professionals.

“Salary increases are stagnant for mid-level finance and accounting workers, and starting pay is lower — say, $38,000 instead of $40,000,” the director said.

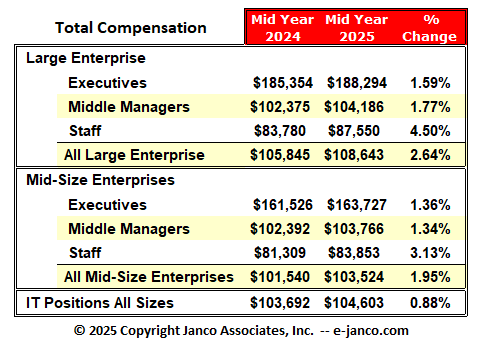

Similarly, the 2009 IT Salary Survey by Janco Associates found the average information technology salary dropped from $79,005 in January 2008 to $77,367 in January 2009.

Another Consulting Firm said 68 percent of U.S. technology companies have implemented salary freezes, 62 percent have had layoffs, 30 percent mandated time off, and 17 percent suspended 401(k) matches.

Salary research by Robert Half International calls for continued “flat or modest declines” in accounting, finance, IT and administrative starting salaries next year.

Meanwhile, salaried employees, accustomed to average annual raises of about 3 percent to 4 percent, this year were in line for half that, according to the Society for Human Resource Management.

But one of the biggest challenges to workers’ economic comfort will rear its head in the current open enrollment season for employer-sponsored health insurance plans.

To continue to afford health insurance, many employers have shifted compensation costs from wages and salaries to the benefits side of the ledger, effectively cutting into raises, bonuses, profit-sharing or 401(k) matches.

And most are asking employees to shoulder higher premium costs or bigger deductibles